As we usher in 2024, the landscape of trading continues to evolve, bringing forth advanced platforms and services aimed at enhancing the trader’s experience. In this Tickmill Review, we delve into the features, tools, and overall performance of Tickmill, a broker known for its competitive spreads, reliable execution, and user-centric approach. This review aims to provide traders with a comprehensive overview of what to expect from Tickmill’s offerings in the coming year, highlighting both strengths and areas for improvement. Whether you’re a novice trader seeking to understand the basics or an experienced professional looking for a robust trading environment, our Tickmill Review will offer valuable insights to help you make informed decisions. Stay tuned as we explore Tickmill’s account types, trading platforms, customer support, and more, ensuring you have all the information needed to enhance your trading journey in 2024.

Features of Tickmill Platform

The Tickmill platform boasts a range of features designed to provide traders with a seamless and efficient trading experience. With cutting-edge technology and user-friendly design, the platform ensures that both novice and experienced traders can access the tools they need to succeed. Below is a table highlighting the main features of the Tickmill platform.

| Feature | Description |

|---|---|

| Competitive Spreads | Offers some of the lowest spreads in the industry, making trading more cost-effective. |

| Reliable Execution | Ensures fast and reliable order execution to capitalize on market opportunities. |

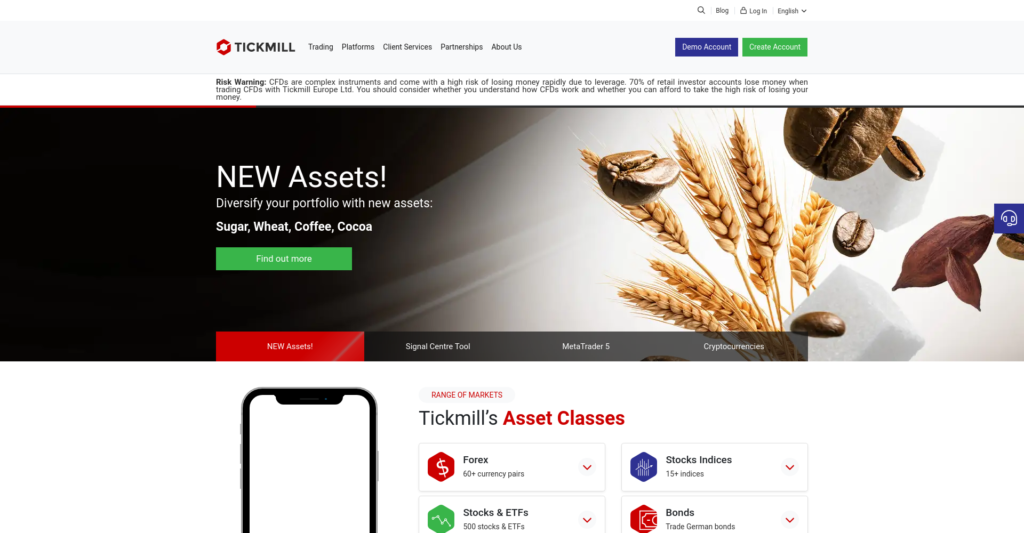

| Variety of Instruments | Access to a wide range of trading instruments, including Forex, commodities, indices, and cryptocurrencies. |

| Advanced Charting Tools | Incorporates powerful charting tools to help traders perform technical analysis with ease. |

| Customizable Interface | Allows traders to customize the trading interface according to their preferences. |

| Robust Security | Implements cutting-edge security measures to protect traders’ funds and personal information. |

| Educational Resources | Provides a wealth of educational materials to help traders enhance their trading skills. |

What is Tickmill Platform?

Tickmill platform is a sophisticated trading solution catered to both retail and institutional investors. Established with the mission to provide optimal trading conditions, Tickmill stands out for its stringent regulatory oversight and transparent operations. The platform encompasses a wide array of assets including Forex, commodities, indices, and cryptocurrencies, allowing traders to diversify their portfolios effectively. Equipped with state-of-the-art technology, Tickmill ensures rapid order execution and minimal slippage, which are critical for successful trading. Additionally, it boasts a customizable interface that adapts to individual trading styles, making it user-friendly for newcomers and seasoned traders alike. Comprehensive educational resources and robust security features further enhance its reputation as a reliable and secure trading environment. In essence, what is Tickmill platform is a reflection of an advanced, accessible, and secure trading hub for diverse market participants.

Tickmill Review: Pros & Cons

In this Tickmill Review, we will examine both the advantages and drawbacks of using the platform. The following table provides a balanced view of what users can expect from Tickmill, helping you make an informed decision about whether it meets your trading needs.

| Pros | Cons |

|---|---|

| Low trading costs due to competitive spreads. | Limited educational resources for advanced traders. |

| Fast and reliable order execution. | Restricted payment options in some regions. |

| Wide variety of trading instruments, including Forex, commodities, indices, and cryptocurrencies. | No proprietary trading platform, relying mainly on MetaTrader. |

| Robust security features to protect user funds and information. | Customer support may have extended response times during peak periods. |

| Customizable interface tailored to individual trading preferences. | Limited availability of bonus and promotional offers. |

Who Owns Tickmill?

Tickmill is owned by Tickmill Group, which comprises various entities operating under the Tickmill brand. The group is regulated by multiple financial authorities, enhancing its credibility and trustworthiness in the trading industry. Key figures behind Tickmill’s success include industry veterans with extensive experience in financial markets and trading technologies. While specific names of individual owners are not publicly disclosed, the executive team’s expertise and leadership have been instrumental in establishing Tickmill as a reputable broker worldwide. The group’s commitment to transparency, innovation, and client satisfaction underscores their dedication to providing optimal trading conditions for both retail and institutional investors.

How does Tickmill official website work?

The Tickmill official website is designed to offer an intuitive and user-friendly experience for traders of all levels. Below are the clear steps detailing how the platform works:

- Registration: Begin by visiting the Tickmill official website and clicking on the ‘Open Account’ button. Fill in the required personal details and complete the registration process to create a trading account.

- Verification: After registering, you will need to verify your identity by uploading the necessary documents such as a government-issued ID and proof of address. This step ensures compliance with regulatory policies.

- Funding: Once your account is verified, you can deposit funds using one of the available payment methods. The website provides multiple options, including bank transfers, credit/debit cards, and e-wallets.

- Platform Access: After funding your account, you can download the trading platform of your choice (e.g., MetaTrader 4 or MetaTrader 5) directly from the Tickmill official website. Follow the installation instructions to set up the platform on your device.

- Trading: Log in to the platform using your account credentials. You can start trading by selecting your preferred financial instruments. The Tickmill website offers comprehensive market analysis tools, charts, and educational resources to aid your trading decisions.

- Monitoring and Management: Use the website to monitor your trades, manage your account settings, and access additional features such as account statements and trading history. The interface is designed to be easily navigable, ensuring you can efficiently manage your trading activities.

The Tickmill official website provides a seamless and efficient trading experience, guiding users through every step, from registration to executing trades and managing their accounts.

How to Start Trading with Tickmill?

To start trading with Tickmill, the process is straightforward and designed to be user-friendly for traders of all levels. First, you will need to open an account on the Tickmill official website by providing your personal details and creating a secure password. After the initial registration, the next step involves verifying your identity by uploading your government-issued ID and proof of address, which ensures compliance with international regulations. Following verification, you can fund your account through various payment methods such as bank transfers, credit/debit cards, or e-wallets. Once your account is funded, download the trading platform of your choice, typically MetaTrader 4 or MetaTrader 5, directly from the Tickmill website. With your account set up and funds in place, you are ready to start trading with Tickmill, accessing a wide range of financial instruments and advanced trading tools to help you achieve your trading goals.

How to sign up in Tickmill?

Signing up for Tickmill is a straightforward process designed to get you trading as quickly and efficiently as possible. To begin, follow these detailed steps to complete your registration:

- Visit the Tickmill Official Website: Navigate to the Tickmill website and locate the ‘Open Account’ button at the top right corner of the homepage.

- Complete the Registration Form: Click on the ‘Open Account’ button, which will take you to the registration form. Here, you will need to provide your personal information, including your full name, email address, phone number, and country of residence. Make sure all details are accurate to avoid any issues during verification.

- Create Account Credentials: After filling in your personal information, you will need to create a username and password. Choose a strong password to ensure the security of your account. Confirm your password and proceed to the next step.

- Account Verification: To comply with regulatory requirements and ensure the security of all users, you will need to verify your identity. Upload a clear, government-issued ID (such as a passport or driver’s license) and a recent document that proves your address (such as a utility bill or bank statement).

- Receive Confirmation: Once you have submitted your documents for verification, you will receive a confirmation email. This process can take a few hours to a couple of days, depending on the verification workload.

- Fund Your Account: After your account is verified, log in to your new Tickmill account and proceed to the deposit section. Choose your preferred payment method from the available options, like bank transfers, credit/debit cards, or e-wallets, and fund your account with your initial deposit.

- Download Trading Platform: With your account funded, access the trading platform of your choice through the Tickmill website. Download MetaTrader 4 or MetaTrader 5, and follow the installation instructions to set up the platform on your computer or mobile device.

- Start Trading: After setting up your trading platform, log in using your Tickmill account credentials. You are now ready to start trading with a wide range of financial instruments and utilize Tickmill’s powerful trading tools to enhance your trading experience.

Following these steps to sign up in Tickmill will ensure a smooth and hassle-free registration process, setting you up for success in your trading endeavors.

How to invest in Tickmill?

To invest in Tickmill, you will first need to deposit funds into your trading account. Follow these comprehensive steps to make a deposit and get started:

- Log In to Your Account: Begin by logging into your Tickmill account using your username and password. If you haven’t created an account yet, complete the registration and verification process first.

- Access the Deposit Section: Once logged in, navigate to the client area on the Tickmill official website. Look for the ‘Deposit’ or ‘Funds’ section in the dashboard menu.

- Select Your Deposit Method: Tickmill offers a variety of deposit methods, including bank transfers, credit/debit cards, and e-wallets. Choose the deposit method that best suits your needs.

- Enter Deposit Details: After selecting your preferred deposit method, you will be prompted to enter the amount you wish to deposit. Ensure you meet the minimum deposit requirements set by Tickmill.

- Fill in Payment Information: Provide the necessary payment details, such as bank account number, credit card information, or e-wallet credentials. Double-check that all information is correct to avoid any delays in processing your deposit.

- Confirm the Deposit: Review your deposit details and confirm the transaction. Depending on your chosen method, you may need to complete additional security steps, such as entering a one-time password (OTP) sent to your phone or email.

- Wait for Funds to Reflect: The processing time for your deposit can vary based on the method chosen. Bank transfers may take a few business days, while credit/debit card and e-wallet transactions are typically faster. Monitor your account balance to ensure the funds are credited.

- Start Trading: Once your deposit is successfully processed and the funds are reflected in your account balance, you can now start investing in Tickmill. Access the trading platform, select your trading instruments, and begin executing trades.

By following these steps to invest in Tickmill, you ensure a smooth and efficient deposit process, allowing you to focus on your trading strategies and investment goals.

Tickmill Minimum Deposit

The Tickmill minimum deposit requirement is designed to provide accessibility to traders of all levels. Whether you are a novice trader looking to enter the market or an experienced professional aiming to expand your trading portfolio, understanding the minimum deposit is crucial. To start trading with Tickmill, the minimum deposit amount varies depending on the type of account you select. Here is a detailed guide to help you navigate this aspect of the platform:

- Classic Account: The Classic Account is ideal for beginners. The Tickmill minimum deposit for this account type is set at a modest amount, typically around $100. This allows new traders to start with a lower financial commitment while still accessing the range of trading instruments and features Tickmill offers.

- Pro Account: The Pro Account caters to more experienced traders. For this account, the Tickmill minimum deposit is generally higher, usually starting at $500. This account type offers lower spreads and additional tools that are beneficial for those with a deeper understanding of the markets.

- VIP Account: Designed for high-volume and institutional traders, the VIP Account comes with a Tickmill minimum deposit requirement of $50,000. This account offers the most competitive trading conditions, including the lowest spreads and personalized support.

- Deposit Methods: Regardless of the account type, Tickmill provides multiple deposit options including bank transfers, credit/debit cards, and e-wallets. Each method has its own processing time and fee structure, so choose the one that best suits your needs.

- How to Deposit: To make a deposit, log in to your account, navigate to the ‘Deposit’ section, select your preferred payment method, and enter the amount. Follow the on-screen instructions to complete the transaction. Once the funds are credited to your account, you can begin trading immediately.

Understanding the Tickmill minimum deposit requirements ensures that you can make informed decisions about which account type and deposit method are best suited to your trading strategy and financial capabilities.

Is Tickmill has a demo account

Tickmill offers a demo account designed to provide traders with a risk-free environment to practice and refine their trading strategies. A Tickmill demo account mimics real market conditions, allowing both novice and seasoned traders to familiarize themselves with the trading platform, test new techniques, and gain confidence before committing real funds. Here is a detailed guide to help you understand the features and how to get started with a Tickmill demo account:

- Registration: To open a Tickmill demo account, visit the Tickmill official website and click on the ‘Open Demo Account’ button. Fill out the registration form with your personal details, including your name, email address, and phone number.

- Account Setup: After completing the registration, you will receive an email with your demo account login credentials. Use these credentials to log into the trading platform, either MetaTrader 4 or MetaTrader 5, which you can download directly from the Tickmill website.

- Practice Trading: The Tickmill demo account comes preloaded with virtual funds, typically up to $100,000. This allows you to practice trading without any financial risk. You can access the same range of financial instruments and features available in a live account, including Forex, commodities, indices, and cryptocurrencies.

- Risk Management: Use the demo account to experiment with different risk management techniques, such as setting stop-loss and take-profit levels. This practice helps you understand how to manage your positions effectively in a live trading scenario.

- Analyze Performance: Track your trading performance using the advanced charting tools and analysis features available on the platform. Review your trades and strategies to identify strengths and areas for improvement.

- Transition to Live Account: Once you feel confident with your trading skills and strategies on the demo account, you can smoothly transition to a live account by following the standard registration and funding procedures on the Tickmill website.

By utilizing a Tickmill demo account, traders can gain valuable experience and enhance their trading skills in a simulated, risk-free environment, making it an essential tool for anyone looking to succeed in the financial markets.

Tickmill Trading App Review

The Tickmill trading app stands out as a highly efficient and user-friendly mobile solution for traders who want to stay connected to the markets on the go. Available for both iOS and Android devices, the app offers seamless access to a wide range of financial instruments, including Forex, commodities, indices, and cryptocurrencies. Designed with a sleek, intuitive interface, the Tickmill trading app allows users to execute trades quickly, monitor market trends, and manage their portfolios with ease. One of the key features of the app is its advanced charting tools, which enable traders to perform in-depth technical analysis directly from their mobile devices. Additionally, the app integrates robust security measures to ensure the safety of users’ transactions and personal information. With real-time notifications, customizable settings, and comprehensive market data, the Tickmill trading app makes it convenient for both novice and experienced traders to stay informed and make informed decisions, no matter where they are.

Is Tickmill Legit or Scam?

When evaluating whether Tickmill is legit or scam, it’s essential to consider its regulatory status, user feedback, and operational transparency. Tickmill is a reputable and well-regulated broker, providing traders with a secure trading environment. The company operates under the oversight of several prominent regulatory authorities, including the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and the Seychelles Financial Services Authority (FSA). These regulatory bodies enforce stringent rules and standards, ensuring that Tickmill adheres to industry best practices, provides transparency in its operations, and safeguards client funds.

Moreover, Tickmill has garnered positive reviews from its user base, reflecting satisfaction with its services, trading conditions, and customer support. The broker offers competitive spreads, reliable execution, and a variety of financial instruments, which are crucial factors for traders. Additionally, Tickmill’s commitment to client education through comprehensive resources and its robust security measures further solidifies its legitimacy.

Overall, when querying “Tickmill legit or scam,” the evidence strongly supports that Tickmill is a legitimate and trustworthy broker, providing a safe and efficient trading platform for both retail and institutional investors.

Which countries does Tickmill support?

Tickmill supported countries span across the globe, providing access to traders from almost every corner of the world. Whether you’re in Europe, Asia, Africa, or the Americas, Tickmill’s services are designed to meet the diverse needs of international clients. The broker complies with strict regulatory requirements in various jurisdictions to ensure a secure and transparent trading environment. This widespread availability makes Tickmill a truly global broker, committed to catering to the financial needs of traders everywhere. By offering localized support and adhering to international standards, Tickmill ensures a seamless trading experience for its global clientele.

Is Tickmill Scam or Not?

When examining whether Tickmill is a scam or not, it’s important to delve into regulatory certifications, customer reviews, and the overall transparency of the company. Concerns about “Tickmill fake” or “Tickmill scam” are unfounded, as the broker is thoroughly regulated by credible authorities such as the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC). These stringent regulations ensure that Tickmill operates with the highest standards of financial integrity and client protection.

Additionally, Tickmill has received positive feedback from a broad base of traders who praise its competitive spreads, reliable order execution, and user-friendly platforms. The transparency in their operations and robust customer support further dispels any notions of Tickmill being a scam or delivering fake promises. Therefore, based on regulatory oversight and customer testimonials, it is clear that Tickmill is a legitimate and trustworthy broker, committed to providing a secure and efficient trading environment.

What is Tickmill Trustpilot Rate?

The Tickmill Trustpilot rate is a strong reflection of its reputation in the trading community. With a high rating on Trustpilot, Tickmill has garnered positive feedback from a vast number of users who commend its competitive trading conditions, responsive customer service, and reliable execution. The numerous five-star reviews highlight clients’ satisfaction with Tickmill’s transparency, robust security measures, and user-friendly platforms. This high Trustpilot rate underscores Tickmill’s commitment to providing an exceptional trading experience, making it a preferred choice for traders globally.

Do we recommend to invest in Tickmill?

Based on our comprehensive review and analysis, we highly recommend making Tickmill investments for both novice and experienced traders. Tickmill offers a range of advantages that make it an attractive option for anyone looking to invest in the financial markets. Firstly, its competitive spreads and low trading costs provide significant savings, enhancing your potential for profitability. The platform’s reliable order execution ensures that you can capitalize on market opportunities swiftly and efficiently. Additionally, Tickmill’s robust regulatory oversight by respected authorities like the FCA and CySEC guarantees a secure trading environment, giving you peace of mind about the safety of your funds.

Tickmill also offers a variety of account types tailored to suit different trading needs, whether you’re aiming to start small with their Classic Account or engaging in high-volume trading through their VIP Account. The user-friendly platform supports popular trading tools such as MetaTrader 4 and MetaTrader 5, providing a seamless trading experience. Lastly, the extensive educational resources available make Tickmill investments a smart choice, particularly for those seeking to improve their trading skills and knowledge. Thus, we confidently recommend Tickmill as a reliable and efficient broker for your investment needs.

FAQ: Tickmill

What is Tickmill trading?

Tickmill trading is an online trading platform that allows users to trade various financial instruments, such as forex, commodities, and indices, through a user-friendly interface and advanced trading tools.

Who owns Tickmill?

The owner of Tickmill platform is a group of global financial and brokerage experts with extensive industry experience.

How to invest in Tickmill?

To start with Tickmill investments, create an account on their platform, verify your identity, deposit funds, and choose from available trading assets. Detailed guidance is provided on their website.

How to sign up in Tickmill?

To complete the Tickmill sign up, visit the Tickmill website, click on ‘Create Account,’ fill out the registration form with your details, and submit the form. Verify your email and log in to start trading.

Which Tickmill is legit?

The legitimate Tickmill can be verified by visiting the official Tickmill website, ensuring secure and accurate information.

How trustworthy is Tickmill?

The trustworthy of Tickmill is reflected in its regulation by top financial authorities, transparency in operations, and positive customer reviews.

How to use Tickmill?

To use Tickmill, start by opening an account on the official website. Deposit funds through available payment methods and download the trading platform. Use the provided tools and resources to analyze markets and execute trades.

Raul Tapia